All Activity

- Today

-

One interesting angle on ways to make money is looking at individuals who have successfully built wealth through diverse ventures. Ben Meiselas Net Worth reflects a combination of smart investments, strategic business moves, and leveraging opportunities in both real estate and entrepreneurship. Studying such examples can provide practical insights into creating multiple income streams and making informed financial decisions.

-

I spent most of the day running errands and catching up on a few household chores, but I also treated myself to lunch at a local spot. I checked out the filibertos menu and ended up trying a few items I hadn’t had before. It was a nice way to break up the day and enjoy some good food while taking a little time for myself.

-

heavylearner joined the community

-

MonetizeBetter would like to wish all members celebrating their birthday today a happy birthday: Donald Max (33)beltswallets (26)Bymaxx (24)lawrence68 (45),

-

State-of-the-art сryptocurrency mixer 💰 Our service does not "mix transactions," but immediately issues CLEAN cryptocurrency with low AML. The principle is simple: you give us your coins, we return our clean coins to you, without any traces or unnecessary procedures. ✔ Complete confidentiality. No "pseudo-mixers" — at the exit, a transaction without traces. ✔ Flexible commission. From 2% to 6%, depending on the destination and amount. ✔ Popular currencies: LTC, BTC, ETH, USDT, BNB, XRP, XMR, TRX. Others available upon request. ✔ Ready accounts ✔ Business accounts ✅ Account Qonto Business 🗂️ 2 in stock ✅ Account Finom Business 🗂️ 1 in stock ✅ Account PayPal Business 🗂️ 1 in stock ✅ Account Wallester Business 🗂️ 1 in stock ✅ Account Stripe Business 🗂️ 1 in stock ✅ Account Wittix Business 🗂️ 2 in stock ✅ Account Ebay com Seller US|EU, new 🗂️ 2 in stock ✅ Account Blackcatcard Business 🗂️ 2 in stock ✅ Account Mistertango Business 🗂️ 1 in stock ✅ Account Payset Business 🗂️ 1 in stock ✅ Account Wise Business 🗂️ 1 in stock ✅ Account Revolut Business 🗂️ 2 in stock Payments-system / Crypto-Exchange ✅ Account AlchemyPay 🗂️ 1 in stock ✅ Account Astropay 🗂️ 1 in stock ✅ Account 4x4 io 🗂️ 1 in stock ✅ Account Bunq 🗂️ 2 in stock ✅ Account Bilderlings 🗂️ 1 in stock ✅ Account BitPay 🗂️ 1 in stock ✅ Account Bitinvestor / swapped 🗂️ 1 in stock ✅ Account Bitmex 🗂️ 1 in stock ✅ Account Bitsa 🗂️ 3 in stock ✅ Account Blackcatcard 🗂️ 1 in stock ✅ Account Btcdirect 🗂️ 1 in stock ✅ Account BBVA 🗂️ 1 in stock ✅ Account Binance 🗂️ 2 in stock ✅ Account Bitget 🗂️ 1 in stock ✅ Account Blackwell Global 🗂️ 1 in stock ✅ Account Brighty app 🗂️ 4 in stock ✅ Account Bankera 🗂️ 1 in stock ✅ Account Coinbase card 🗂️ 1 in stock ✅ Account Coinfinity 🗂️ 1 in stock ✅ Account Capitalist 🗂️ 2 in stock ✅ Account CoinW 🗂️ 1 in stock ✅ Account Coinmetro 🗂️ 1 in stock ✅ Account Coinpayments 🗂️ 1 in stock ✅ Account Cryptomus 🗂️ 1 in stock ✅ Account Curve 🗂️ 3 in stock ✅ Account Cryptopay 🗂️ 1 in stock ✅ Account Egera 🗂️ 1 in stock ✅ Account e PN 🗂️ 1 in stock ✅ Account FasterPay 🗂️ 1 in stock ✅ Account Finci 🗂️ 1 in stock ✅ Account fillit eu 🗂️ 1 in stock ✅ Account Gate 🗂️ 3 in stock ✅ Account Grey 🗂️ 1 in stock ✅ Account HTX (Huobi) 🗂️ 1 in stock ✅ Account IN1 🗂️ 1 in stock ✅ Account Imagenpay 🗂️ 1 in stock ✅ Account ICard 🗂️ 1 in stock ✅ Account IPRoyal 🗂️ 1 in stock ✅ Account Kraken 🗂️ 3 in stock ✅ Account Kucoin 🗂️ 1 in stock ✅ Account Kauri Finance 🗂️ 1 in stock ✅ Account Kriptomat 🗂️ 1 in stock ✅ Account Luno 🗂️ 1 in stock ✅ Account LuxonPay 🗂️ 1 in stock ✅ Account MEXC 🗂️ 1 in stock ✅ Account MyBrocard 🗂️ 1 in stock ✅ Account Moonpay 🗂️ 2 in stock ✅ Account Monzo 🗂️ 1 in stock ✅ Account moneyjar world 🗂️ 1 in stock ✅ Account Naga Pay 🗂️ 1 in stock ✅ Account Nash 🗂️ 1 in stock ✅ Account Nebeus 🗂️ 1 in stock ✅ Account Nexo 🗂️ 1 in stock ✅ Account Nearpay 🗂️ 2 in stock ✅ Account Neteller 🗂️ 1 in stock ✅ Account N26 🗂️ 1 in stock ✅ Account OKX 🗂️ 1 in stock ✅ Account PayDo 🗂️ 1 in stock ✅ Account Paypal 🗂️ 3 in stock ✅ Account Paysera 🗂️ 1 in stock ✅ Account PST 🗂️ 1 in stock ✅ Account Paybis 🗂️ 1 in stock ✅ Account Payoneer 🗂️ 1 in stock ✅ Account Paysafecard 🗂️ 2 in stock ✅ Account Paytend 🗂️ 1 in stock ✅ Account Quppy 🗂️ 1 in stock ✅ Account RedotPay 🗂️ 1 in stock ✅ Account Ramp 🗂️ 1 in stock ✅ Account Revolut 🗂️ 1 in stock ✅ Account Santander 🗂️ 1 in stock ✅ Account Spendl 🗂️ 1 in stock ✅ Account Skrill 🗂️ 1 in stock ✅ Account Swapin 🗂️ 3 in stock ✅ Account Trustee Plus 🗂️ 1 in stock ✅ Account Valora 🗂️ 1 in stock ✅ Account Volet 🗂️ 1 in stock ✅ Account W1TTY 🗂️ 1 in stock ✅ Account Wallet Telegram 🗂️ 1 in stock ✅ Account Weststein 🗂️ 1 in stock ✅ Account Wirex 🗂️ 1 in stock ✅ Account Wise 🗂️ 4 in stock ✅ Account Whitebit 🗂️ 1 in stock ✅ Account Wittix 🗂️ 1 in stock ✅ Account XGo 🗂️ 1 in stock

- Yesterday

-

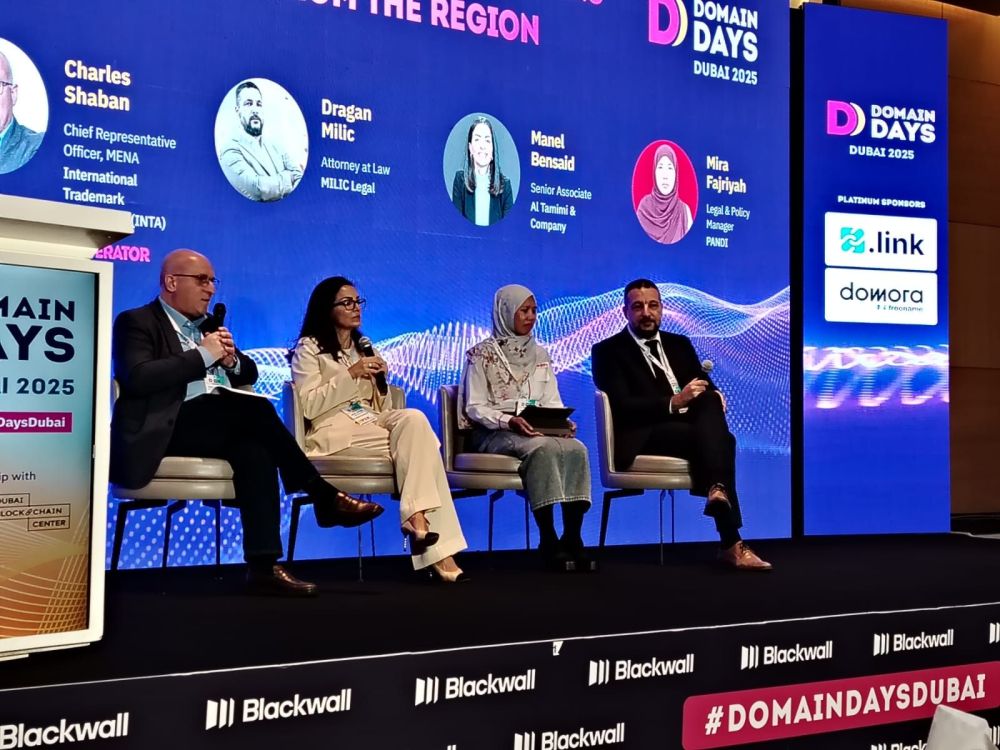

official Domain Days Dubai 2025 - October 22 & 23, 2025, Dubai

Daniel replied to Daniel's topic in Conferences & Events

Hello Domain & Digital Assets People! Domain Days Dubai 2025 was an absolute success! Over 300 decision-makers, investors, and entrepreneurs gathered on October 22–23 to connect, exchange ideas, and explore new opportunities in the domain and digital assets space. Huge credit to Munir Badr, Jason Nickerson, and the entire team for once again raising the bar for industry events. I personally had the chance to meet and reconnect with great people in this industry. I’ll try to tag as many as possible in this post, in no particular order. Here are a couple of pictures from the event: -

KeyProxy joined the community

-

willyjohn joined the community

-

为什么选择独享静态住宅 IP 长会话更稳定:持久连接减少上下文波动,保障持续运营稳定性 [1] 环境可复制可移交:标准化配置便于团队内沉淀与规模化扩展 [1] 固定城市降低波动:城市级定位一致性提升内容推荐与用户交互相关性 [1] 数据驱动更精准:固定变量减少干扰,提升评估与迭代的准确性 [2]

-

wand4391 joined the community

-

Annette livegood started following Reliable Java hosting is in need ...

-

Reliable Java hosting is in need ...

Annette livegood replied to MelissaZane's topic in Hosting & Domain Providers

I can help -

Annette livegood started following Brandy

-

Annette livegood started following Jose Luis

-

Annette livegood joined the community

-

Reliable Support for Video Downloads with PYPROXY's Unlimited Proxies!

PYPROXY replied to PYPROXY's topic in Proxy Providers

PYPROXY's Halloween event has begun, with surprise discounts waiting for you to discover! -

🎉 Halloween Special Alert! 🎉 Get ready to treat yourself with IP2World's amazing Halloween offer! Enjoy our unlimited proxy IP packages starting at just $2138/month! Don’t miss out on this spooktacular deal! 🕷️✨ For more information, contact us: Email: service@ip2world.com WhatsApp: +852 5513 9884 Want to learn more? Visit our website: IP2World Grab this deal before it vanishes into thin air! 🧙♀️💨

-

🌍 Discover Premium Static ISPs from Multiple Countries! 🌍

IP2WORLD replied to IP2WORLD's topic in Proxy Providers

The Halloween event has begun! -

What? IP2world Just Upgraded Its Unlimited Proxy IP Pool! 🚀

IP2WORLD replied to IP2WORLD's topic in Proxy Providers

The Halloween event has begun! - Last week

-

Should I use services from scalahosting.com for hosting my e-shop? Is this a sound idea?

-

I am looking for a reliable Java hosting provider as I plan to host my Tomcat website and jvmhost.com is in my mind, do you know anything about this company?

-

Need a dedicated server for my online shop

MelissaZane replied to Sovegeko's topic in Hosting & Domain Providers

Have a look at servers from time-tested companies, I mean hostingsource.com (50% off the first month) and planethoster.com. I can say the level of service they provide is top notch. No problems whatsoever with their service and support responds quickly and most important accurately. -

Bonus from OnClickA: claim +12% on top-ups Until the end of this month, all advertisers can claim a bonus on top-ups. It’s a simple way to expand your budget and gain more flexibility for testing and campaign growth. If this is your first deposit with OnClickA: Use the promo code BEGIN12 and get +12% from your first deposit of $100 or more, up to $500. The bonus gives you additional resources to explore the platform, test different formats, and start your campaigns with an extra boost from day one. If you’re already running campaigns with OnClickA: Use the promo code BOOST12 and get +12% on deposits starting from $150, up to $200 in bonus funds. The extra budget helps you get even more from your ongoing campaigns, giving you space to optimize performance, test new approaches, and achieve even more results. Both offers are valid until October 31, 2025 Activate your bonus today and make every deposit more efficient. Claim your first bonus Claim bonus for active advertisers

-

Selling Gmail USA IP | Gmail MIX IP | Outlook Old accounts

BURZH replied to BURZH's topic in Social Media Services

You can buy a YouTube channel with views in our bot using the link below TG bot: https://t.me/Raccoonstockbot Channel: https://t.me/RaccoonStock Contact: https://t.me/changreta -

ShaneGiven joined the community

-

#CryptoMarket #DeFi On Capitol Hill, industry executives and senators are gathering — not just for “talks,” but at a pivotal moment for structural change across the entire crypto industry. As the Responsible Financial Innovation Act (RFIA) and other market-structure bills advance, the regulatory focus is shifting quickly from the asset layer of “Bitcoin and Ethereum” to the organizational architecture and liability of “decentralized finance (DeFi)” protocols and platforms. For the industry, this is not only about a path to compliance; it could reshape business models, competitive dynamics, and the sector’s regulatory standing. According to reports, top crypto executives and Donald Trump’s “crypto czar” David Sacks will convene on Capitol Hill to meet Senate Republicans and Democrats working to move market-structure legislation forward. Their goal: restart bipartisan talks and get a bill to President Trump before the midterms make it a secondary priority. Roughly ten industry leaders are expected to attend, including: Coinbase CEO Brian Armstrong; Galaxy Digital CEO Mike Novogratz; Kraken CEO Dave Ripley; Chainlink CEO Sergey Nazarov; Uniswap CEO Hayden Adams; Circle Chief Strategy Officer Dante Disparte; Ripple Chief Legal Officer Stuart Alderoty; Jito Chief Legal Officer Rebecca Rettig; a16z crypto General Counsel Miles Jennings; Solana Policy Institute Director Kristin Smith; Paradigm VP of Regulatory Affairs Justin Slaughter. Background to the Market Structure Bills: Why Is “Structure” More Complex Than “Assets”? In recent years, the crypto industry has pressed for a unified federal framework to replace a fragmented, enforcement-first, after-the-fact approach. The U.S. Congressional Research Service (CRS) notes that fragmented oversight of crypto markets leads to overlapping intermediaries, platforms, and asset types — and muddled agency jurisdiction. By 2025, a bigger lever appeared: stablecoin legislation such as the GENIUS Act has passed, marking a systemic step forward in fiat digitalization. Next up, the real challenge is rule-setting for trading, clearing, lending, and decentralized protocols — i.e., the market structure layer. From recent reporting we can see: multiple industry leaders (including Coinbase’s Brian Armstrong and Chainlink’s Sergey Nazarov) met senators to discuss the market structure bill and DeFi regulation. This signals that regulation must go beyond asset classification (securities vs. commodities) and drill into protocol forms, platform roles, user protection, and compliance responsibility — a far more complex task than simple asset rules. Why Has DeFi Become the Core Controversy? Although Bitcoin and other digital assets have long drawn regulatory scrutiny, the real “core topic” of this legislative cycle is DeFi. Reasons include: Disintermediation challenges the traditional regulatory blueprint Traditional finance rules target intermediaries (banks, exchanges, custodians). DeFi protocols often lack clear intermediary roles: no obvious corporate HQ, no day-to-day “middleman company,” but rather open-source code and self-executing smart contracts. Drafts from Democratic senators explicitly bring front-ends, protocol controllers, and operators under the umbrella of digital asset intermediaries. If this sticks, many DeFi protocols could face registration, KYC/AML, and disclosure obligations — directly touching their native decentralization. Large risk exposure and obvious blind spots The proposals prioritize preventing regulatory arbitrage and illicit finance via DeFi. Protocol structures can facilitate cross-border lending, algorithmic leverage, and anonymous liquidations — gaps regulators deem urgent to address. Industry fears that defining front-ends or protocol controllers as intermediaries will sap innovation, raise compliance costs, or infringe decentralized user rights. As reported, the proposal “infuriated much of the industry.” Restarting talks and the need for certainty The meetings aim to restart negotiations and reduce uncertainty. As one Chainlink executive said afterward, both sides have “considerable common ground,” but process and timelines remain unclear. The dialogue suggests a framework is taking shape — and the industry must prepare. Positions and Policy Fault Lines Key disputes currently center on: (1) Who is the lead regulator: SEC, CFTC, or Treasury? Historically, securities fall under the SEC and commodities under the CFTC. Crypto blurs that line. Democratic drafts reportedly give Treasury authority to assess whether a project is “sufficiently decentralized” and to sweep it into the “digital asset intermediary” bucket. A potential three-headed oversight raises concerns about overlap, clarity, and compliance cost. (2) Protocol vs. intermediary: where is the regulatory touchpoint? Regulating companies as intermediaries is familiar terrain. Extending oversight to open-source protocols, front-end UIs, or tacit yield control vastly expands the scope. Drafts that treat “front-end applications” as intermediaries are especially contentious. Industry voices argue that making protocols bear intermediary obligations conflicts with Web3 design principles and risks stalling innovation. (3) Timelines and legislative priority. While Coinbase’s CEO says a bill “could pass this year,” relevant Senate committees have paused sessions, and timelines may slip to next year. In practice, both parties are tying “final dates” to conditions, leading to gridlock. Result: even with strong intent, the path from draft to law is not linear. Industry Impact: From Acceleration to Compliance Transformation As regulatory structure is rebuilt, the crypto industry will see shifts: A. Business model rewiring Many DeFi protocols have touted “permissionless, intermediary-free” designs. If new rules treat front-ends or protocol operators as intermediaries with KYC/AML duties, costs could rise and flexibility fall. Some projects may exit the U.S. or refactor toward deeper decentralization. B. Higher compliance costs and market entry thresholds Once enacted, a formalization wave will follow: platforms need compliance monitoring, custody standards, audits, and disclosure mechanisms. This is a steeper hill for smaller projects. C. U.S. role and global competitiveness If the U.S. leads with a predictable and industry-friendly market-structure regime, it could attract global capital and projects. If rules are overly strict, capital could flee. Leaders hope to land it before the midterms to cut uncertainty. D. DeFi legalization and innovation pathways Clear rules could give DeFi legitimacy, bolstering user trust and unlocking institutional capital. But if the framework mirrors legacy finance too closely, it could suppress decentralization and first-principles innovation. The sector stands at this fork. Conclusion Crypto is moving from asset innovation to market-structure innovation. As DeFi regulation becomes the core flashpoint of U.S. market-structure legislation, the shift is not just legal — it’s a holistic remapping of ecosystem positioning, business models, and technical design. For the industry, the rational stance isn’t resistance, but to embrace structural change, engage in policymaking, and ensure sustainable compliance. At the same time, regulators must strike a balance: safeguarding innovation while building a reliable, transparent, and competitive market system.