All Activity

- Past hour

-

The UseGateway.net service allows you to accept popular cryptocurrencies and tokens on your website, app, or bot. Connection takes just 1 minute. Register, save your seed phrase — and start accepting payments. The system is perfect for managing multiple stores, bots, applications, or AI agents. Our advantages: All popular cryptocurrencies are available immediately after registration: BTC, LTC, USDT, USDC, TON, BEP, TRX, and more No KYC or verification required for you Optional AML checks for your customers — can be enabled in settings Convenient payment form Responsive support team Clear documentation Guarantees: Cold wallets — only you have access via the seed phrase Impeccable reputation Major clients (bloggers and casinos) — the list is available from support Operating since 2022 Support: Online chat on usegateway.net Telegram: @usegateway

- Today

-

Any seasoned trader will tell you that managing risk is a crucial component of successful trading. Without proper risk management, you might find your capital wiped out faster than anticipated. Therefore, employing effective risk management techniques can help safeguard your investments and allow you to trade with confidence. - Stop Loss Orders: One of the simplest and most effective ways to manage risk is to use stop loss orders. This tool allows you to set a predetermined loss threshold, automatically closing your position if the market moves against you. This technique prevents emotional decision-making and limits potential losses. - Position Sizing: Determine the amount of money you are willing to risk on a single trade. A common rule is to risk no more than 1-2% of your trading capital on any given trade. This ensures that even consecutive losses don’t substantially deplete your funds. - Risk-Reward Ratio: Calculate the risk-reward ratio for each trade to assess whether the potential reward is worth the risk. A common guideline is a risk-reward ratio of 1:2 or higher, meaning you stand to gain at least twice as much as you risk losing. By integrating these risk management techniques into your strategy, you can protect yourself against severe losses and trade more sustainably. OFFICIAL WEBSITE https://www.google-newswire.com/news/ralvixen-review-the-official-updated-site%e3%80%902025%e3%80%91-exploring-ralvixens-smart-algorithms-414/

-

ralvixen joined the community

-

UseGateway changed their profile photo

-

🌴 AdsEmpire is heading to Bangkok for Affiliate World Asia! 🇹🇭 Meet us at booth D47 on December 3–4 for two days of pure networking magic, hot offers, and unstoppable affiliate energy. ⚡ Don’t miss your chance to meet the Empire in person — book a meeting now and let’s make Bangkok unforgettable! 💥 👉Book a Meeting

-

🌎Резидентные прокси (Безлимитный трафик) 💫Ротация на каждый запрос! 🛡Пул 2.5 мл 🖥Подходят для работы с GOOGLE | INSTAGRAM | FACEBOOK | PINTEREST | STEAM | ➡️Ротация на каждый запрос либо по времени. 🌐Гео уточняйте в техподдержке. 🟢Авторизация login:pass. 🟢Безлимитный трафик. 🟢Протокол: HTTP/HTTPS/SOCKS5 🔘Скорость до 10 мб/с 🔘Есть пакеты до 500мб/с 🌎100 threads ✅1 day — $48 ✅7 days — $280 ✅15 days — $520 ✅30 days — $920 🌎500 threads ✅1 day — $128 ✅7 days — $768 ✅15 days — $1320 ✅30 days — $2600 🌎1000 threads ✅1 day — $176 ✅7 days — $1040 ✅15 days — $2000 ✅30 days — $3520 🌎2500 threads ✅1 day — $256 ✅7 days — $1560 ✅15 days — $2640 ✅30 days — $5200 📨Техподдержка: ✉️ BIGPROXY TECHNICAL (https://t.me/bigproxy_support_bot) ✉️ BIGPROXY SUPPORT (https://t.me/bigproxies_bot) 🖥Сайт 👉 https://bigproxy.shop/ 💵Доступна оплата в USDT (TRC20)💵

-

Sports betting apps are transforming the way users consume sports and entertainment. Sports Betting App Development Company has become the most lucrative business on the Internet, as millions of bettors are moving to mobile platforms. Developing a sports betting app is not about just offering the odds and results, it’s about live data feed, a secure payment system, simple UI, and region-wise gaming compliance. Startups and newcomers to betting Tech are rolling out the next generation of offerings, which combine user interaction, scale, and responsible gaming in bespoke packages. If you’re developing one, technologies such as blockchain, live odds APIs, and AI-powered prediction models can make the experience more transparent and reliable for users. The most difficult part is often achieving fairness, managing large amounts of real-time data, and paying out quickly. Whether you are a startup or an established enterprise, you can leverage Sports Betting App Development Company to generate long term revenue through commissions, ads, subscriptions, etc. The trick is to locate a trustworthy development firm that is knowledgeable about the gaming environment and regulatory context. What’s your take?” And now I have several questions. Are you already making one or planning to create one? When it comes to competing in today’s market, what particular challenges or features are most important to success? Let’s discuss! To Know More: Mail: business@bidbits.org Chat on WhatsApp: +91 9080594078

-

- sports betting

- sportsbook

-

(and 1 more)

Tagged with:

-

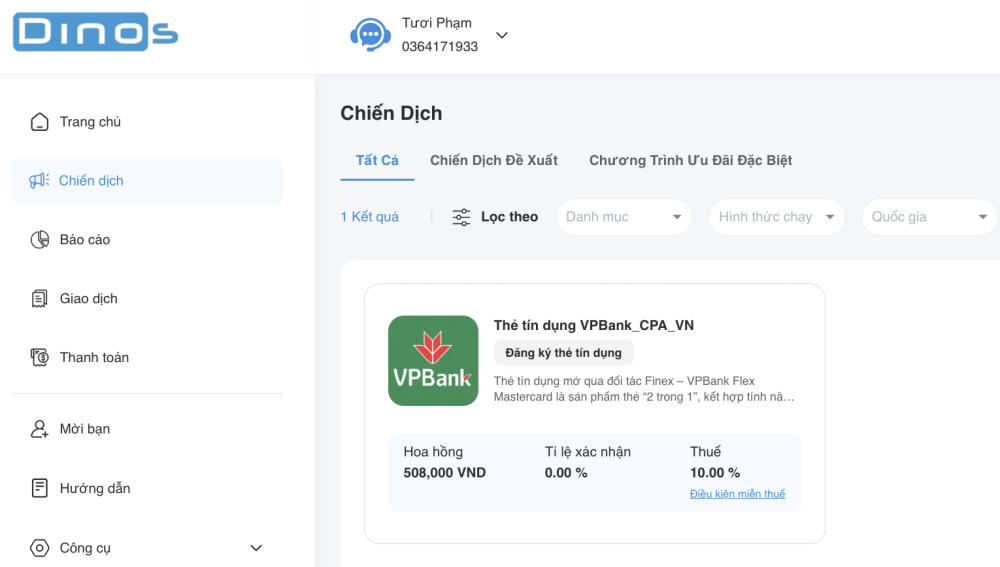

🔥 New Campaign Launch – MB Bank Hoang Quoc Viet is Live on Dinos Vietnam! This financial CPA offer is easy to convert with an attractive commission of ~$3.3 per qualified lead. Just get users to open a new MB Bank account using your referral code and complete their first login — it’s that simple! 👉 Backed by a trusted military bank brand, this offer has a high approval rate and is perfect for all types of publishers. 🔗 Join now: https://account.dinos.vn/offers/detail/1154 Dinos Vietnam – The Trusted Network 🌐 Website: https://dinos.vn?utm_source=Monetize 📣 Facebook: https://www.facebook.com/DinosVietNam

-

MonetizeBetter would like to wish all members celebrating their birthday today a happy birthday: torqueandhammer --olsaonm (30)jananibiz (28)dinaakbari (46),

-

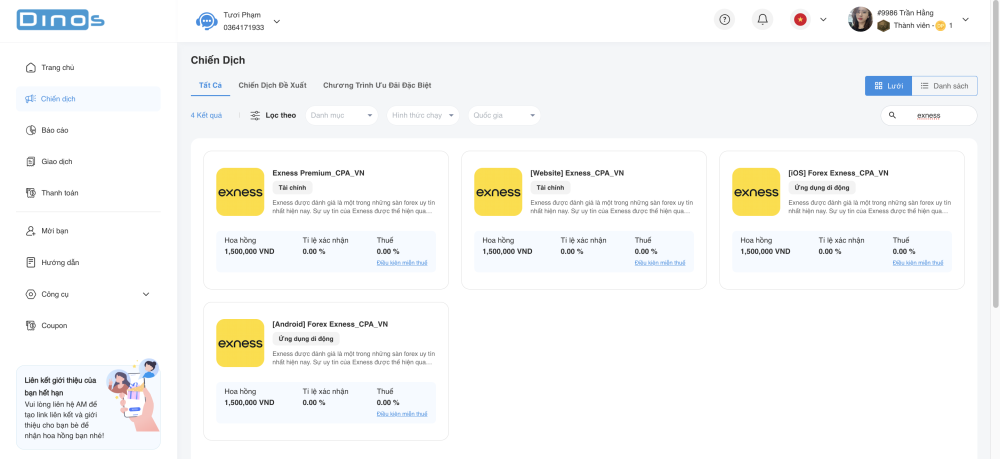

The financial niche has long been considered the “gold mine” of Affiliate Marketing a field where publishers can generate consistent income all year round thanks to steady demand, high payouts, and evergreen campaigns. In this article, Dinos Vietnam reveals the hottest financial offers today, covering Online Loans, Credit Cards, and Crypto three verticals that bring the highest revenue and most stable traffic for publishers. We’ll break down key campaign features, target audiences, and the most effective traffic sources to help you optimize conversions and scale successfully. Credit Card Campaigns Credit card offers are among the most sustainable and conversion-friendly in the finance vertical, trusted by publishers across Dinos Vietnam. Target audience: Individuals with stable income and clear credit history Office employees, freelancers, small business owners Frequent shoppers, travelers, or online service users Payout & Potential: Average payout ranges from $5–$20 per approved lead, depending on the market. Although not as “hot” as payday loans, credit card offers deliver consistent traffic, low risk, and long-term conversion stability. Effective Traffic Sources: Financial review websites or loan comparison pages TikTok channels sharing app reviews or tutorials Facebook Groups, Google Ads (non-brand keywords) Chatbots promoting cashback or credit card bonuses Pros: ✅ Strong brand trust → high CR ✅ Long-term, sustainable traffic Cons: ⚠️ Credit verification may cause some rejection rate Payday Loan Offers Payday loans remain among the highest-earning financial offers at Dinos Vietnam. The global payday loan market reached $8.39 billion in 2023 and is projected to hit $18.09 billion by 2032, proving the massive and growing demand for short-term financial solutions — especially in emerging markets like Vietnam, India, the Philippines, and Indonesia. Target audience: Students, entry-level workers Freelancers, low-income employees Young families or people with limited credit history Payment Models: CPL (Cost Per Lead): Earn commission when the user submits the loan form CPS (Cost Per Sale): Earn commission once the loan is successfully disbursed CPL models are easier to scale, while CPS offers higher payouts and more stable traffic quality. Effective Traffic Sources: Personal finance blogs or loan review pages TikTok short-form reviews Facebook Ads, Google Ads (no brand bidding) Telegram chatbot campaigns Pros: ✅ High payout ($1–$15 per lead, depending on GEO) ✅ Strong CR, scalable with optimized audience ✅ Daily payout and fast cash flow Cons: ⚠️ ROI can fluctuate monthly ⚠️ High competition — requires fresh creative testing Crypto Exchange Offers If you’re looking for high payouts and low competition, crypto exchange offers are your go-to. As the global crypto market continues to grow, the demand for account registrations and first deposits is surging. Leading exchanges like Binance, ByBit, and Exness are now offering commissions from $20–$40 per qualified user, especially after completing KYC or making their first deposit. Target audience: Young users (18–35) interested in tech and digital finance Crypto investors and small-scale traders Users experienced in Forex, CFD, or trading apps Advantages: ✅ High payout ($20–$40 per user) ✅ Multiple commission actions (KYC, deposit, trade) ✅ Strong global brands, easy to promote ✅ Rapidly expanding market Effective Traffic Sources: Blogs about crypto & digital investment YouTube & TikTok tutorial content Telegram & Facebook investment groups Native ads or banner ads targeting investors Special Program: Dinos Vietnam is currently partnering with Exness, offering an exclusive affiliate program with commissions up to ~$40 per qualified user. 👉 Don’t miss your chance to skyrocket your earnings in the Crypto vertical! Why Finance Offers Are Always a Safe Bet The finance niche remains one of the most reliable and profitable verticals in Affiliate Marketing. With trustworthy offers, strong conversion rates, and year-round demand, publishers can build a sustainable income system with Dinos Vietnam. Why Choose Dinos Vietnam for Financial Offers: ✅ 300+ global financial offers – Payday, Credit Card, Crypto ✅ Attractive payouts – up to $40 per lead ✅ Fast payments & 24/7 withdrawal support ✅ Expert AMs to optimize your traffic and scale campaigns ✅ Smartlink & API tracking for accurate performance Thousands of publishers are already earning with Dinos every day — are you ready to be the next one? 👉 Sign up at Dinos.vn and start promoting high-paying financial offers now! Register an Affiliate Account at Dinos

-

NeironVPS.com is not a newcomer to the web hosting industry by any stretch of the imagination, and has been in business since 1999 starting out with their own infrastructures, networks, and in-house staff. If you are looking for a web hosting solution that can provide TRUE 24/7 semi-managed support, NeironVPS will be able to more than meet your needs. Due to the fact that we have real people taking care of all of our tickets, we can guarantee that 99% of the tickets that are put into our system will have a personal reply to them within 30 min. The hosting provider is backed by many years of experience, and due to that experience we have implemented a significant amount of disaster planning in order to preserve any enterprise-level data, and the services surrounding that data. Check out Neironvps.com NVMe VPS Hosting Packages: Every VPS Servers we offer includes full root access, enabling you to run whatever you wish whenever you want to. NVMeVPS1 Starting at $5.95/month - ORDER NOW CPU 1хE5-2680v4 Dedicated RAM 1 GB Disk Space NVMe 10GB Bandwidth 1 TB per Month Locations - USA, Los Angeles; Germany, Nuremberg; Switzerland, Zurich NVMeVPS2 - Starting at $7.95/month - ORDER NOW CPU 1хE5-2680v4 Dedicated RAM 2 GB Disk Space NVMe 20GB Bandwidth 2 TB per Month Locations - USA, Los Angeles; Germany, Nuremberg; Switzerland, Zurich NVMeVPS4 - Starting at $14.95/month - ORDER NOW CPU 2хE5-2680v4 Dedicated RAM 4 GB Disk Space NVMe 30GB Bandwidth 4 TB per Month Locations - USA, Los Angeles; Germany, Nuremberg; Switzerland, Zurich NVMeVPS8 - Starting at $34.95/month - ORDER NOW CPU 4хE5-2680v4 Dedicated RAM 8 GB Disk Space NVMe 50GB Bandwidth 6 TB per Month Locations - USA, Los Angeles; Germany, Nuremberg; Switzerland, Zurich Operating Systems: CentOS, Ubuntu, Debian, Windows Server. Additional Options VPS Server: ISPmanager Lite - Starting at $10/month ISPmanager Business - Starting at $25/month cPanel/WHM - Starting at $35/month Additional IPs - Starting at $2/month Here are Neironvps.com dedicated servers: Datacenter: USA, Los Angeles Dual X5680 Starting at $99/month - ORDER NOW CPU Intel Xeon 2xX5680 Dedicated RAM 16 GB Disk Space SSD 100 GB IP IP's 1 Bandwidth 10 TBs Dual E5-2670 Starting at $149/month - ORDER NOW CPU Intel Xeon 2xE5-2680 v3 Dedicated RAM 64 GB Disk Space SSD 2 X 512 GB IP IP's 1 Bandwidth 30 TBs Datacenter: Germany, Nuremberg Server i7-6700 Starting at $99/month - ORDER NOW CPU CPU Intel® Core™ i7-6700 Dedicated RAM 16 GB Disk Space SSD 100 GB IP IP's 1 free Bandwidth 10 TB per Month Server i7-8700 Starting at $149/month - ORDER NOW CPU CPU Intel® Core™ i5-13500 Dedicated RAM 64 GB Disk Space SSD 2 x 512 GB IP IP's 1 free Bandwidth 20 TB per Month Datacenter: Switzerland, Zurich Server E3-1220 Starting at $99/month - ORDER NOW CPU Intel® Xeon E3-1220 V3 Dedicated RAM 16 GB Disk Space SSD 100GB IP IP's 5 Bandwidth 10 TB per Month Server 2xX5670 Starting at $299/month - ORDER NOW CPU Intel® Xeon 2xX5670 Dedicated RAM 64 GB Disk Space HDD 2 X 2TB IP IP's 28 Bandwidth 50 TB per Month Feel free to Contact US! 19 Carbeen ave. St Ives, NSW, 2075 sales@neironvps.com Support 24/7: 1(800)685-14-55

-

HostingSource, Inc. is a leading hosting provider, offering reliable, scalable solutions for customers of all sizes and services. We supply all of the servers, software, bandwidth and management tools needed to run almost any web hosted application - from small to enterprise server solutions. The staff has over 30 years of experience in the IT field. HostingSource.com has access to all the major carriers within the New York and New Jersey area without the need for local loop circuits. The servers are powered by Intel processors, each equipped with high-performance memory giving you the best hosting experience. Our Hardware and telecommunication resources are completely redundant to the needs of our customers. Check out Hostingsource.com Dedicated Servers Special - Dedicated Cloud, AMD, MacOS, GPU: Dedicated Cloud Unlimited Bandwidth Servers: CLOUD 1: 8 CPU CORES, 12GB RAM, 200GB NVME Storage, DDOS Protection - (Discount 12%) $39/mo - ORDER CLOUD 2: 10 CPU CORES, 16GB RAM, 300GB NVME Storage, DDOS Protection - (Discount 15%) $49/mo - ORDER CLOUD 3: 12 CPU CORES, 24GB RAM, 400GB NVME Storage, DDOS Protection - (Discount 20%) $69/mo - ORDER CLOUD 4: 16 CPU CORES, 32GB RAM, 500GB NVME Storage, DDOS Protection - (Discount 25%) $84/mo - ORDER AMD Servers: AMD EPYC 7282: 16 CORES, 2.1 GHZ, 64GB RAM, 2 X 2TB NVME SSD, DDOS Protection - (Discount 10%) $129/mo - ORDER AMD EPYC 7402P: 24 CORES, 2.8 GHZ, 128GB RAM, 2 X 2TB NVME SSD, DDOS Protection - (Discount 15%) $159/mo - ORDER AMD RYZEN 9 7950X: 16 CORES, 2.8 GHZ, 128GB RAM, 2 X 2TB NVME SSD, DDOS Protection - (Discount 20%) $199/mo - ORDER AMD EPYC 7502: 32 CORES, 2.2 GHZ, 128GB, 2 X 2TB NVME SSD, DDOS Protection - (Discount 25%) $229/mo - ORDER AMD EPYC 7K62: 48 CORES, 2.5 GHZ, 128GB RAM, 2 X 2TB NVME SSD, DDOS Protection - (Discount 25%) $320/mo - ORDER 2x AMD EPYC 7502: 64 CORES, 2.5 GHZ, 256GB RAM, 2 X 4TB NVME SSD, DDOS Protection - (Discount 30%) $599/mo - ORDER XEON Servers: XEON E5 2650V4: 12 CORES, 2.2GHZ, 64GB, 2 X 2TB SSD, DDOS Protection - (Discount 10%) $119/mo - ORDER XEON E5 2680V4: 14 CORES, 2.4GHZ, 128GB RAM, 2 x 2TB SSD, DDOS Protection - (Discount 15%) $139/mo - ORDER XEON E5 2697V4: 18 CORES, 2.3GHZ, 128GB, 2 x 2TB SSD, DDOS Protection - (Discount 20%) $169/mo - ORDER 2x XEON E5 2680V4: 28 CORES, 2.4GHZ, 128GB, 2 x 2TB SSD, DDOS Protection - (Discount 25%) $209/mo - ORDER 2x XEON E5 2699V4: 44 CORES, 2.2GHZ, 128GB, 2 x 2TB SSD, DDOS Protection - (Discount 25%) $310/mo - ORDER 2x XEON GOLD 6230R: 52 CORES, 2.1GHZ, 256GB, 4 x 2TB SSD, DDOS Protection - (Discount 30%) $450/mo - ORDER Dedicated MacOS M1 ARM Servers: M1 - Basic: 3.2GHz M1 ARM CPU, 8-core CPU + 8-core GPU, 16-core Neural Engine, 8GB Unified Memory, 256GB X 4TB SSD Storage, 1GB/s Port - (Discount 12%) $79/mo - ORDER M1 - Professional: 3.2GHz M1 ARM CPU, 8-core CPU + 8-core GPU, 16-core Neural Engine, 16GB Unified Memory, 256GB X 4TB SSD Storage, 1GB/s Port - (Discount 15%) $109/mo - ORDER M1 - Advanced: 3.2GHz M1 ARM CPU, 8-core CPU + 8-core GPU, 16-core Neural Engine, 8GB Unified Memory, 512GB X 4TB SSD Storage, 1GB/s Port - (Discount 20%) $99/mo - ORDER M1 - Expert: 3.2GHz M1 ARM CPU, 8-core CPU + 8-core GPU, 16-core Neural Engine, 16GB Unified Memory, 512GB X 4TB SSD Storage, 1GB/s Port - (Discount 25%) $119/mo - ORDER Dedicated MacOS M2 ARM Servers: M2 - Basic: 3.4GHz M2 ARM CPU, 8-core CPU + 10-core GPU, 16-core Neural Engine, 8GB Unified Memory, 256GB X 4TB SSD Storage, 1GB/s Port - (Discount 12%) $89/mo - ORDER M2 - Professional: 3.4GHz M2 ARM CPU, 8-core CPU + 10-core GPU, 16-core Neural Engine, 16GB Unified Memory, 512GB X 4TB SSD Storage, 1GB/s Port - (Discount 15%) $139/mo - ORDER M2 - Advanced: 3.4GHz M2 ARM CPU, 8-core CPU + 10-core GPU, 16-core Neural Engine, 24GB Unified Memory, 512GB X 4TB SSD Storage, 1GB/s Port - (Discount 20%) $199/mo - ORDER M2 - Expert: 3.4GHz M2 Pro ARM CPU, 10-core CPU + 16-core GPU, 16-core Neural Engine, 32GB Unified Memory, 1TB X 4TB SSD Storage, 1GB/s Port - (Discount 25%) $299/mo - ORDER DEDICATED GPU SERVERS (Extreme Performance Business Servers): Tesla GPU - Professional: AMD EPYC 7502 – 32 Cores, 64GB Ram, 2 x 2TB NVME Raid-1, NVIDIA Tesla P40 GPU, 24GB DDR5 – 3840 CUDA Cores, FPS32 Output: 11.76 TFLOPS - $249/mo ORDER Tesla GPU - Expert: AMD EPYC 7502 – 32 Cores, 128GB Ram, 2 x 2TB NVME Raid-1, NVIDIA Tesla V100 GPU, 16GB DDR5 – 5120 CUDA Cores, FPS32 Output: 14.13 TFLOPS - $299/mo ORDER Quadro GPU - Professional: AMD EPYC 7502 – 32 Cores, 128GB Ram, 2 x 2TB NVME Raid-1, NVIDIA Quadro A4000 GPU, 16GB DDR6 – 6144 CUDA Cores, FPS32 Output: 19.17 TFLOPS - $329/mo ORDER Quadro GPU - Expert: AMD EPYC 7502 – 32 Cores, 128GB Ram, 2 x 2TB NVME Raid-1, NVIDIA Quadro A5000 GPU, 24GB DDR6 – 8192 CUDA Cores, FPS32 Output: 27.77 TFLOPS - $349/mo ORDER GeForce GPU - Professional: AMD EPYC 7502 – 32 Cores, 128GB Ram, 2 x 2TB NVME Raid-1, NVIDIA GeForce RTX 3090 GPU, 24GB DDR6 – 10496 CUDA Cores, FPS32 Output: 35.58 TFLOPS - $359/mo ORDER GeForce GPU - Expert: 2 x AMD EPYC 7502 – 64 Cores, 256GB Ram, 2 x 2TB NVME Raid-1, NVIDIA GeForce RTX 4090 GPU, 24GB DDR6 – 16384 CUDA Cores, FPS32 Output: 82.58 TFLOPS - $599/mo ORDER OPTIONAL FEATURES: Windows OS WHM/Cpanel Additional IPs MANAGED SERVICES: Basic Support – Free Advanced Plan – $19/Month Professional Plan – $39/Month DEDICATED SERVER VOLUME DISCOUNTS: 6 Month Prepaid – 10% Discount! 12 Month Prepaid – 15% Discount! 24 Month Prepaid – 20% Discount!

-

#Modular Blockchain #Education Series If you’ve been following crypto’s technical evolution, you’ve likely heard the term “Modular Blockchain.” From Celestia and EigenLayer, to newer stars like Dymension and Saga, and even Ethereum’s ever-expanding L2 ecosystem — “modularity” has become synonymous with next-generation infrastructure. But what exactly is modularity? And why do many call it “the next great revolution after Ethereum”? This article breaks down everything — from the origins and logic of modular blockchains, to their real-world significance and how they will reshape Web3’s foundational architecture. From Monolithic to Layered: The Evolution of Blockchain Architecture Before modularity, blockchains were monolithic. Think of a monolithic blockchain as a “one-stop factory” — everything happens in-house: Consensus layer: Who produces blocks and how are they validated? Execution layer: How are transactions and smart contracts executed? Data availability layer: How are transaction data broadcast, stored, and verified? Settlement layer: How is final state confirmed and disputes resolved? In early systems like Bitcoin and early Ethereum, these functions were all bundled into one. While simple and secure, this design had major drawbacks: Performance bottleneck: Every node must process every transaction, limiting throughput (TPS). Scaling difficulty: The larger the chain, the heavier and more costly it becomes to run. Limited flexibility: Changing or optimizing one part affects the entire system. The modular solution emerged from a simple insight — instead of having one chain do everything, let different layers specialize. The Core Idea: Division of Labor and Cooperation “Modular” means splitting a blockchain’s core functions so that each module (or chain) handles a distinct task. It’s like cloud computing: the frontend handles interfaces, the backend handles logic, and databases handle storage. Each focuses on what it does best — the result is massive overall efficiency. In modular architecture, we typically see these specialized layers: Execution Layer: Runs transactions and smart contracts (e.g., Arbitrum, Optimism, Polygon zkEVM) Settlement Layer: Confirms finality and arbitrates disputes (e.g., Ethereum, Fuel) Data Availability (DA) Layer: Stores and verifies transaction data (e.g., Celestia, Avail, EigenDA) Consensus Layer: Orders transactions and creates blocks (e.g., Tendermint, CometBFT) This “layered design” brings decoupling and coordination: Each module can upgrade or swap independently. Developers can mix-and-match components freely. Scalability and flexibility rise dramatically. In short: modularity makes blockchains as composable as LEGO bricks — and this modularity is not just elegant, but a revolution in efficiency. In monolithic chains, every node performs all tasks — like having every factory worker design, produce, and inspect simultaneously. Modularization “outsources” tasks: consensus layers order blocks, execution layers run contracts, data layers ensure availability. This division allows horizontal scalability — when demand grows, you don’t overhaul the entire system, you just deploy more execution layers. It’s the blockchain equivalent of the microservices revolution in Web2. Even better, modules interact via standardized communication protocols (APIs, bridging layers, proofs): Execution layer submits results to settlement layer; Settlement layer verifies and finalizes; Data is stored and verified by the DA layer. For example, in the Celestia + Rollup model, Celestia handles data storage and broadcasting, while the Rollup handles execution. The two coordinate via Validity Proofs or Fraud Proofs, and final settlement occurs on a main chain (e.g., Ethereum). The result? Speed and security, combined. For Developers: A New Building Paradigm In the past, launching a new blockchain meant designing everything — consensus, validation, tokenomics — from scratch. Now, developers can simply assemble components: use Celestia for data, Fuel for execution, and launch instantly. What once felt like “building a rocket” now feels like “assembling a drone.” The entry barrier and cost have dropped dramatically. For Users: Seamless Experience, Hidden Complexity End users may not even notice modularity — but they’ll feel it. Their DApps may run across multiple execution layers, but security and assets remain protected by a main settlement layer. This means: Lower fees, Faster confirmation times, Richer DApp ecosystems — without worrying about cross-chain trust. For the Ecosystem: A New Industry Structure The modular paradigm creates open markets between execution, data, settlement, and consensus providers. Teams specialize in different layers — much like AWS handles storage, Cloudflare handles networking, and Stripe handles payments. Thus, modularity isn’t just a tech trend — it’s an industrial restructuring that moves blockchain from isolated silos to an interoperable, composable network economy. Why It’s Revolutionary: Three Dimensions of Change 1. Performance Boost: Parallel, Lightweight Execution In monolithic systems, each node processes everything — bottlenecks are inevitable. Modularity lets execution layers run light, while data and consensus are offloaded. Celestia focuses purely on data availability. Rollups handle execution and post results upstream. This division sharply improves TPS and reduces node load. 2. Shared Security: Small Chains, Big Safety Previously, launching a secure chain meant building your own validator network — expensive and slow. Modularity allows security inheritance: Rollups use Ethereum for settlement. EigenLayer introduces restaking, letting staked ETH secure multiple services. New projects can thus launch quickly, cheaply, and securely. 3. Open Ecosystem: Composable and Interoperable Chains are now “modules” that can be freely combined: Use Celestia for DA, Ethereum for settlement, Deploy your own execution layer. Like LEGO bricks, the combinations are endless, forming a true Internet of Blockchains. Key Modular Projects Celestia — The Modular Pioneer The first blockchain focused exclusively on data availability. It doesn’t execute smart contracts; it serves as a universal DA layer for others. Celestia’s launch marked the dawn of the modular blockchain era. EigenLayer — Restaking and Shared Security Built within Ethereum’s ecosystem, EigenLayer lets ETH stakers “restake” their assets to secure other protocols. Think of it as Ethereum providing security, while EigenLayer reallocates it efficiently. This enables fast, low-cost network bootstrapping and shared trust. Dymension — The RollApp Universe Dymension offers a modular framework for developers to launch RollApps — rollups customized like building a website. Its slogan, “The Internet of RollApps,” captures its ambition to be the operating system for modular app-chains. Avail, Saga, Fuel — Expanding the Modular Frontier Avail (from the Polygon family) specializes in DA. Saga automates AppChain deployment. Fuel focuses on high-performance execution through parallelization. Together, they form a rich modular ecosystem — each a critical infrastructure piece for the Web3 stack. Modular Blockchain and Ethereum: Rivalry or Evolution? Far from being rivals, modular blockchains are Ethereum’s natural evolution.Ethereum itself is shifting toward modularity: Execution Layer: Handles contracts and transactions. Consensus Layer: Manages PoS validation. DA Layer: Future Danksharding / EIP-4844 to scale data throughput. Thus, Ethereum is transforming from a monolith into a modular hub. Rollups, L2s, and EigenLayer only extend its scalability and longevity. The Broader Impact on Web3 Modularity isn’t just a technical upgrade — it’s a paradigm shift: Lower entry barriers: New projects launch faster by reusing shared layers. Greater interoperability: Standardized modules enable smoother cross-chain operations. Ecosystem growth: Specialists in each layer form strong network effects. More innovation: Small teams can build niche chains — gaming, RWA, privacy, etc. In the future, Web3 may consist of hundreds of lightweight execution chains, anchored by a few robust settlement and data networks — forming a modular super-ecosystem. Conclusion: Modularity Restores Blockchain’s Freedom Over the past decade, blockchain has evolved from Bitcoin’s singular system, to Ethereum’s smart-contract platform, to today’s multi-layer collaborative architecture. Each leap redefines what “decentralized efficiency” means. Modularity isn’t just a buzzword — it’s the industry’s collective trajectory. It enables faster development, greater performance, stronger security, and, crucially, mass adoption potential. Soon, we might stop asking “Which chain is stronger?” and instead start asking — “Which modular combination best fits your application?”

-

FrankFort joined the community

-

official Tell us your favorite Crypto Forex Broker

FrankFort replied to Daniel's topic in 🏆 MonetizeInfo Awards

I’ve been using blackeaglefg.com for a while now, and honestly, I like how fast their withdrawals are. The platform’s layout isn’t confusing, which helped me get stuff done quicker without second-guessing every click. I also had a question about margin rates once and their support didn’t keep me waiting forever like others I’ve tried. It’s been solid for me so far, especially during high-volume trading times. - Yesterday

-

felltraveler joined the community

-

Shintwinkle joined the community

-

Proxies and data security — a shield or a double-edged sword? Proxies are often seen as a synonym for anonymity. But in reality, they're a tool that can either protect you or completely destroy your digital security — it all depends on whose hands they're in. To: — Hide your IP and protect yourself from network attacks — Avoid tracking and geolocation leaks — Work through a secure communication channel — Keep your traffic confidential You need reliable proxies What's inside: — How a proxy hides your real IP and protects you from DDoS — HTTPS vs. SOCKS5: what's the difference in protection level — Why free proxies are the #1 source of data leaks — How unsafe proxy owners steal logins and card data — Security checklist: DNS & WebRTC leaks, logging policy, "bad neighbor effect" We've posted the full security guide on our blog

-

Selling Gmail USA IP | Gmail MIX IP | Outlook Old accounts

BURZH replied to BURZH's topic in Social Media Services

You can buy Firstmail/T-online/Notletters email through our bot using the link below. We've also added the following items: ▪️ MAIL.COM 2024 I WEB only ▪️ GMX.COM I POP3 I IMAP I SMTP ▪️ Gmail MIX IP I NEW ▪️ Mail.ru WEB I 180+ days I MIX I RUS ▪️ WEB.DE I 20-23 y. I TRUST ▪️ GMX.CH I 20-23 y. I TRUST ▪️ GMX.AT I 20-23 y. I TRUST ▪️ Gmail OLD I MIX IP I 19-22 y. ▪️ Gmail I 14-60+ DAYS I TRUST ▪️ Telegram USA I TDATA I 2FA ▪️ Telegram CANADA I TDATA I 2FA ▪️ GMX.FR I POP3 I IMAP I SMTP ▪️ GMX.COM I 2020-2023 I TRUST I USED ▪️ Firemail.de IMAP/POP3 TRUST ▪️ Rambler MIX I SMTP I IMAP I POP3 ▪️ AOL MAIL I OLD I SMTP I IMAP ▪️ GMAIL EDU I NON GMAIL.COM I 7DAYS TG bot: https://t.me/Raccoonstockbot Channel: https://t.me/RaccoonStock Contact: https://t.me/changreta -

If you’re searching for a simple and effective way to browse the internet privately, you should check out Proxy4Free. It’s a popular website that offers a huge collection of free public proxy servers from all over the world. Whether you want to protect your identity, access blocked websites, or improve your online security, Proxy4Free has you covered. The site provides HTTP and SOCKS proxies, updated frequently to ensure reliability and speed. Each proxy entry includes key details such as IP address, port, country, speed, uptime, and anonymity level, making it easy to find the right one for your needs. Proxy4Free is completely free to use, with no registration or software installation required. The interface is clean, user-friendly, and suitable for both beginners and professionals who need quick proxy access. Overall, Proxy4Free is one of the best and most trusted platforms for anyone who values online privacy and unrestricted internet access. website:https://www.proxy4free.com/

-

#ET #binance #okx For crypto investors, beyond stablecoins and memecoins, the native tokens of major exchanges are also top-priority investment targets. If we say: Investing in stablecoins pursues stability and safety; Investing in memecoins pursues high returns; Then investing in exchange tokens pursues stability + high value potential. As the “core equity” and “liquidity lubricant” of an exchange ecosystem, platform coins have long been favored by investors. They not only represent a platform’s brand, user base, and governance capability, but also embed its future growth runway, ecosystem expansion, and competitive edge. Put simply: as long as the platform doesn’t collapse, its token is unlikely to go to zero; and the token’s value growth tends to correlate with the platform’s own growth. Therefore, in crypto markets many people treat exchange tokens as a kind of alternative RWA — after all, each platform coin is anchored to a real-world operating company: the exchange. This article takes platform coins as the main thread. We’ll start from the definition and significance of platform coins, then look at four exchanges — Binance, OKX, Huobi, SuperEx — to introduce each platform’s current state, the role of its token, and future growth potential. By the end, you’ll better understand “why exchange tokens deserve attention” and “how to evaluate them when investing.” The Meaning and Essence of Platform Coins 1) What is a platform coin? A platform coin is a platform-specific token issued or affiliated with an exchange, typically used to: Pay trading fees on the platform and receive discounts; Participate in platform governance (e.g., voting, proposals) or as part of loyalty incentives; In some designs, earn staking rewards, dividends, or benefit from buyback/burn mechanisms — giving the token a hybrid “equity–token” character. As one industry write-up puts it: “These tokens are part of the exchange ecosystem, enhancing user stickiness, fundraising capacity, and platform security.” 2) Why platform coins matter to exchanges At a macro level, platform coins bring multi-dimensional value to exchanges: Ecosystem binding: Holding the token often grants users preferential treatment (fee discounts, priority rights, airdrops), strengthening retention and forming a platform–user–token loop. Capital & expansion tool: Issuance raises funds for operations and builds an ecosystem token economy, aiding product launches and international expansion. Liquidity & market signal: Strong token performance and price appreciation reflect market confidence in the platform’s ecosystem and growth; weakness can flag issues in traffic, products, or regulation. Governance & defense: Tokens can power governance, risk controls, and incentives — raising competitive moats. 3) Core drivers of platform-token growth To judge whether a platform coin has growth potential, focus on: Exchange volume & user growth: More flow → more token utility → stronger demand. Product diversification: Beyond spot — derivatives, Earn, staking, infra — usually benefits the token more. Competition & regulation: In tighter regulatory and competitive environments, compliant, scaled platforms have more room to grow. Tokenomics: Buybacks/burns, staking rewards, governance — these affect scarcity and value support. Market signals & brand: Price action, brand strength, inclusion in indices/ETFs can add confidence premium. 4) Risk reminders: platform coins aren’t “sure things” If an exchange faces liquidity stress, regulatory probes, or a trust crisis, the token can drop sharply. Prices can be pumped by speculation, decoupling from fundamentals. Poor tokenomics (e.g., heavy unlocks, broken governance) can dilute value. In broad downcycles, even strong platforms’ tokens can be dragged lower. Deep Dives: Four Major Exchanges’ Tokens 1. Binance and BNB As the world’s largest crypto exchange, Binance holds roughly 39–40% market share. BNB launched in 2017 — initially for fee discounts, later expanding to the BNB Chain ecosystem, staking, buybacks, and burns. BNB is a multi-purpose token in Binance’s stack: fee discounts, Launchpad eligibility, on-chain applications, etc. Binance’s trading volume, huge user base, and internationalization underpin BNB’s fundamentals. BNB is also the native token of BNB Chain, giving it the dual role of platform token + chain token. Upside drivers: Continued international expansion and licensing progress could support volumes. Ongoing BNB buybacks/burns and on-chain ecosystem growth support value. Smart-chain DeFi, NFTs, and GameFi can further increase utility. Watch-outs: Global regulatory pressure — major fines or licensing setbacks could dent confidence. Platform tokens are sentiment-sensitive and vulnerable in bear markets. BNB’s value partially relies on BNB Chain activity; slowing growth there would weigh on BNB. 2. OKX and OKB Founded in 2013, OKX operates globally and issues OKB. OKX performs strongly in derivatives. OKB offers fee discounts, membership perks, and margin rebates. OKX is building its own chain ecosystem (X Layer), with OKB as a key token. OKB is tightly bound to OKX’s strategy: internationalization + product expansion + track extension. Upside drivers: Expanding across regions (e.g., Middle East, Southeast Asia) brings user growth. Broader product lines (wallet, NFT, marketplace, DeFi) can boost OKB utility. Regulatory breakthroughs would benefit the token. Watch-outs: Versus Binance, OKX lags on brand and scale; token awareness may be capped. If derivatives face tighter rules, the token may be indirectly affected. Long-term execution of buyback/burn and release policies needs monitoring. 3. Huobi (HTX) and HT Huobi, now HTX, is an older brand that has internationalized. Under China’s tighter rules, international pivot is key. The HT token has typically powered membership tiers, fee discounts, and Earn on the platform. After peaking in 2023, HT’s price fell as Chinese operations wound down; it’s now roughly top-50 by market cap globally. Early brand/user accumulation is an asset; despite regulatory changes, HTX still holds advantages in overseas markets. Growth potential: If HTX gains ground in Asia, the Middle East, and Africa, the token could appreciate. A shift toward a “trading + asset-management + chain-ecosystem” model would diversify token utility. Watch-outs: Legacy China regulatory baggage may affect international trust and compliance status. Market share has long trailed Binance/OKX; upside may be constrained. Token design, ecosystem activity, and user stickiness need proof of genuine transformation. 4. SuperEx and ET SuperEx is a rising exchange with what it calls the world’s largest, truly decentralized DAO community. Over the past four years it has grown rapidly, currently citing 1,000+ registered users, 600k+ social followers, and DAO coverage across 20+ countries/regions — providing strong potential value support for its token ET. Growth potential: Large user base and high market buzz: at launch, ET topped Twitter trending for 3 straight days and became one of the fastest “100x” tokens, helping SuperEx hit a record 2M+ daily online users. DAO-driven upside: SuperEx DAO (across 20+ countries/regions) offers a powerful foundation for ET’s value extension. ET is deeply tied to DAO governance, empowering ecosystem growth. Stable appreciation: Unlike many platform tokens with high volatility, ET’s price growth has been relatively steady. For example, during 2023–2024 ET saw a full year of sustained price increases — exactly the stability many crypto investors seek. Three Core Factors for Investing in Platform Coins From the five cases above, focus on three dimensions when evaluating platform tokens: Platform scale & growth: Market share, user count, product breadth, and internationalization are the base. Tokenomics: Real utility (fee discounts, staking, governance), and scarcity mechanisms (buyback/burns, locking) directly affect value. Ecosystem expansion & compliance: Beyond matching orders, is the platform expanding into asset management, Earn, or base-layer infrastructure? Lower regulatory risk = stronger long-term token potential. Even with excellent design and strong narratives, don’t overlook execution, transparency, and user trust. When choosing platform coins, make sure the exchange has healthy core business performance, rather than relying on token hype alone. Conclusion As tokenized representations of exchange ecosystems, platform coins have unique value in crypto. From user incentives and platform expansion to capital formation and ecosystem binding, they’re not just “exchange add-ons,” but potentially the key carrier of an exchange’s future business growth. Investing in platform coins isn’t just about watching token charts. It’s about judging whether the exchange you favor truly has the four pillars: scale, product strength, governance, and compliance. Grasp that, and you’ll make far fewer missteps in the sea of exchange tokens.

-

Best shared hosting provider ... what is that?

Daniel165 replied to AlexMcPhail's topic in Hosting & Domain Providers

Black Friday Deal: 2 Years for the Price of 1. Get Linux or Windows Hosting from bodHOST. Buy 1 Year and Get 1 Year FREE. Reliable, secure, and affordable hosting with 24/7 support. Order Now: https://www.bodhost.com/web-hosting/linux-shared-hosting -

🇬🇧 Facebook Ad Bundle Review #5 We're thrilled by your reaction to the previous review! We're continuing our series analyzing working ad bundles from SPY services. This time we've found a profitable bundle for the UK targeting the King Kong Cash slot. It's a lesser-known slot series, but the high traffic volumes speak for themselves 👇 ➡️ Read: UK Gambling Case Study - King Kong Cash Don't just copy the bundle - use it as a foundation for hypotheses. Adapt the creative, test other GEOs and mechanics after analyzing the statistics in spy services. #Facebookad | Magic Click | Ask our team a question

-

MonetizeBetter would like to wish all members celebrating their birthday today a happy birthday: Zafrica --MarkBooker (41)Jemma (30)Laurentz (38)Shakila (29)kentsilvester (29),

-

Karen joined the community

-

Best shared hosting provider ... what is that?

Sovegeko replied to AlexMcPhail's topic in Hosting & Domain Providers

How large is your website and what are its storage needs? I am fully satisfied using Centoserver.com shared hosting solutions. They have one click installs that you can install on your server with just one click of a button. This is what premium hosting should look like. You will get pure solid-state (SSD) storage and high-capacity network connectivity that provide blazing fast speeds. -

Dedicated servers with dynamic scaling options?

Sovegeko replied to Matimaka's topic in Hosting & Domain Providers

I appreciate how Regvps.com designs their dedicated hosting services with professionals in mind, offering advanced controls without compromising user-friendliness. They offer everything I need in one place — no need to look elsewhere. Affordable renewal rates.

.thumb.png.de179569632587f98a1f1f37ef188fb4.png)

.thumb.jpg.49be47f4a9a50b54db5f2bfcc7aec8dc.jpg)